Pay Off Your Mortgage Sooner With 2 Easy Steps

HOW TO PAY OFF YOUR MORTGAGE FASTER

Wouldn’t it be correct to pay off your mortgage earlier?

Absorb you ever looked at your mortgage balance and notion to your self has it even budged? I’ve been paying my mortgage for years and I feel luxuriate in I haven’t made noteworthy of a dent even after having re-financed to a lower charge at one point and at closing taking away PMI.

Right here’s an interactive recordsdata to allow you to pay off your mortgage sooner. Bookmark or set this article to Pinterest to withhold coming assist to it.

Now that I’m debt free (rather then my dwelling mortgage) my point of curiosity is on paying off my mortgage! It’s a mammoth purpose of mine but one which I do know is imaginable.

Attain it’s possible you’ll per chance per chance presumably presumably furthermore dangle a purpose to pay off your mortgage sooner?

Casting off mortgage debt will not only free up money every month but it saves hundreds of bucks in hobby. I don’t know about you but I will’t stand paying hobby on the rest so the regarded as paying all that hobby every month correct kills me.

Absorb you ever if truth be told looked at what the valid cost of your residence will seemingly be in the occasion you correct pay the monthly price due every month for 30 years? It’s scary!

So how am I going to pay off my mortgage sooner and how can you?

I’m going to place into effect the 2 following straight forward steps. I’ve if truth be told been doing the first step since the starting set and its one you are going to be in a spot to launch dazzling away even with out a more money.

This first step is even correct for those which might per chance per chance per chance presumably be peaceable paying off debt, saving for retirement and constructing their emergency funds.

I’m going to embed a mortgage calculator into this article so as that you just are going to be in a spot to flee the numbers to your possess mortgage as you be taught this publish. That’s why I’m calling it an interactive recordsdata :).

Okay so let’s launch with step 1!

HOW TO PAY OFF MORTGAGE FAST

Region Up Biweekly Mortgage Funds

Whenever you first and predominant arena up your mortgage price compensation opinion, you are going to be in a spot to acquire a vary from a standard compensation opinion or a bi-weekly compensation opinion. If here isn’t equipped that it’s possible you’ll dangle to set a question to for it. You are going to be in a spot to arena this up at any time so correct give your mortgage company a name and achieve a question to them to arena this up.

With the similar outdated opinion, it would dangle you the chunky 30 years (assuming a 30-three hundred and sixty five days mortgage) to repay the mortgage while a biweekly price opinion will dangle 25 years and 3 months. This is capable of per chance well furthermore set you 4 years and 9 months plus a bunch of hobby. Let’s dangle a stare upon the valid numbers.

Let’s mumble you took out a $250,000.00 mortgage mortgage with an hobby charge of 5.000% and your federal tax charge is 26.000% Whenever you don’t know your tax charge you are going to be in a spot to appear at here.

With this mortgage amount and charge, you are going to be in a spot to demand to pay $1,342.05 per month, while a bi-weekly price opinion will demand a price of $671.03 every other week.

As a consequence, it’s possible you’ll per chance per chance pay only $189,734.44 in hobby with the bi-weekly time table rather then $233,139.46 in hobby with the similar outdated price opinion. Whereas this will consequence in a loss of $11,285.31 in tax advantages, it’s possible you’ll per chance per chance peaceable set a entire of $32,119.72 with the bi-weekly opinion!

The calculator gives you all of this recordsdata! Whilst you acquire your finally ends up in the calculator you are going to be in a spot to click the “Switch to Undeniable English” hyperlink and this might per chance well furthermore showcase the implications.

Calculate your possess mortgage! I made it easy for you by embedding the biweekly mortgage pay off calculator into this article below. Run ahead and launch punching to your possess numbers and gaze how noteworthy it goes to set you with correct this one step.

I luxuriate in how this calculator takes into consideration the tax advantages because I dangle heard many participants argue that paying off your residence isn’t dazzling because you lose out on the tax assist. However as you are going to be in a spot to gaze, you’re peaceable saving hundreds of bucks. For myself, correct not having to pay a mortgage every month is motive ample.

Okay, that step modified into trim straight forward, now let’s trip to step 2!

Create Additional Funds on Your Mortgage

You might per chance per chance per chance presumably presumably furthermore imagine you are going to be in a spot to’t acquire further payments but while you gaze how noteworthy it’s possible you’ll per chance per chance set it’s possible you’ll per chance per chance presumably presumably furthermore correct gain that money to acquire the further payments. Even in the occasion you’re residing paycheck to paycheck finding an further $20 can set you quite quite a bit of bucks over the lifetime of your mortgage.

Let’s dangle a stare upon some examples and then you are going to be in a spot to accelerate to your possess numbers.

Paying correct $20 further a month to your mortgage……….

On this situation, in the occasion you bought out a 30-three hundred and sixty five days mortgage for $250,000.00 with a 5.000% hobby charge, your monthly price (hobby and predominant only) will seemingly be $1,342.05. By the time the 30 three hundred and sixty five days timeframe is entire, it’s possible you’ll per chance per chance presumably presumably furthermore dangle paid $483,133.89 for your residence (yikes).

Whenever you pay correct $20.00 more every month, it’s possible you’ll per chance per chance presumably presumably furthermore dangle paid $474,070.24 for your residence. Right here’s an hobby financial savings of $9,063.65.

Paying $50 further every month………………………

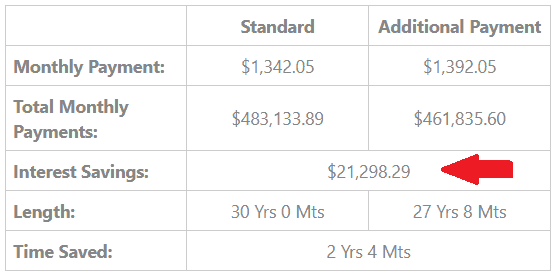

Whenever you pay correct $50.00 more every month, it’s possible you’ll per chance per chance presumably presumably furthermore dangle paid $461,835.60 for your residence. Right here’s a financial savings of $21,298.29. As well to, it’s possible you’ll per chance per chance presumably presumably furthermore acquire the mortgage paid off 2 Years and 4 Months earlier than in the occasion you paid only your usual monthly price.

Pay an further $100 every month………………..

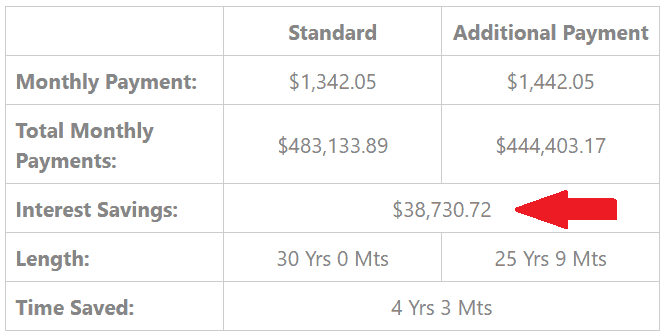

Whenever you bought out a 30-three hundred and sixty five days mortgage for $250,000.00 with a 5.000% hobby charge, to illustrate, your monthly price (hobby and predominant only) will seemingly be $1,342.05. By the time the 30 three hundred and sixty five days timeframe is entire, it’s possible you’ll per chance per chance presumably presumably furthermore dangle paid $483,133.89 for your residence.

Whenever you pay $100.00 more every month, it’s possible you’ll per chance per chance stop up paying $444,403.17 for your residence. Right here’s a financial savings of $38,730.72. As well to, it’s possible you’ll per chance per chance presumably presumably furthermore acquire the mortgage paid off 4 Years 3 Months earlier than in the occasion you paid only your usual monthly price.

Play with the numbers your self, below is the calculator correct enter your numbers and gaze how noteworthy it goes to set you!

By now you acquire the point dazzling? The more you pay every month the more you set because those further payments are going in direction of predominant. You correct ought to be obvious they are applied toward the predominant and that your mortgage has no pre-penalty bills. You are going to be in a spot to correct give your bank a name and achieve a question to.

Now in the occasion you’re in a spot to head into your mortgage with a 15-three hundred and sixty five days mortgage that will per chance per chance presumably effectively be the finest possibility but in the occasion you’re already in a mortgage and likewise you’re not in a spot to refinance to a lower charge with low closing charges then these 2 straight forward steps will allow you to pay off your mortgage sooner.

So now that you just gaze how noteworthy you set and how it’s possible you’ll per chance per chance pay off your mortgage sooner, what produce you’re thinking that? Are you going to place into effect these steps to acquire that mortgage paid off early?

Whenever you came upon this article precious please piece it! Furthermore, set it to Pinterest to consult with later!

Every individual’s circumstance is different so please consult with a talented in the occasion it’s possible you’ll per chance per chance presumably presumably furthermore dangle to, these are correct some pointers to allow you to set.

Pay Off Your Mortgage Sooner With 2 Easy Steps

Yorumlar

Yorum Gönder